One of the best economic journalists that I know is macro-economist Marcel

de Boer of Het Financieele Dagblad in The Netherlands: he is

well-informed, has a very large network with "the top-dogs in the business" and he dares to think out-of-the-box,

which brings him to the not-so-obvious solutions. Marcel de Boer is always a

good and though-provoking read and a darn nice guy on top of it.

This week, in his regular column in the FD, he spoke about

the three most decisive (economic) days during the last twenty

years.

Besides picking ‘9/11’ and the ‘collapse of Lehman Brothers’

as the most decisive days – a choice which I can fully understand even without

endorsing this selection to the fullest – he chose as a

third pick the decision of the OPEC made on November 27, 2014 to leave the oil tap

fully open and not shrink the production of oil.

Here is a (translated) snippet of his very interesting column:

Yesterday, exactly one

year ago, the members of the oil cartel OPEC came together in a cold and grey

Vienna in order to take a decision with far-reaching consequences. Under

pressure of Saudi-Arabia, the oil ministers agreed to leave the oil tap fully

open. The historical policy of the OPEC had always been to shrivel up production when

prices came under pressure, but now the OPEC chose for a different strategy. It

would try to force producers of relatively expensive kinds of oil – deep sea

oil, polar oil and oil from tar sands and shale – out of the market. A few

months of low prices would be sufficient, they thought... Afterwards, the oil

price would recover.

Well, the plan ended

in a fiasco. The oil price further deteriorated, but the expected rebound never

showed up. This was not only due to the fact that China bought less oil, but

also because Iraq started to pump up more oil and the record production in the

US stayed at the high level, due to gargantuous cost savings. All these

circumstances made that supply remained exceeding demand. The oil price dropped

from $ 110 to $45 per barrel.

Well, after reading this though-provoking story, one would

think that the increasing divergence between supply and demand of oil was merely caused by

the excessive global production of oil, due to the ill-conceived strategy of the OPEC

countries, as well as the excessive production in Iraq and the US.

Yet, I was curious if the excess supply in oil was – except for

the diminished oil consumption of China – really the only cause for the

extremely low oil prices of this very moment.

As the testing of the pudding is in the eating, I gathered

some charts and statistics from the International Energy

Agency and other

sources and put the latter in a

tell-tale chart.

The first chart which I want to show is the one containing

the price development of crude and WTI oil. This development has indeed been

dramatical in 2015, tumbling from $92 per barrel to a mere $45 per barrel: a

drop of more than 50%.

|

| The development of the oil price in 2015 Chart courtesy of www.iae.org Click to enlarge |

And the first question to be answered is: is the current oil

production indeed extremely high from a historical point of view?! The answer: yes it

is!

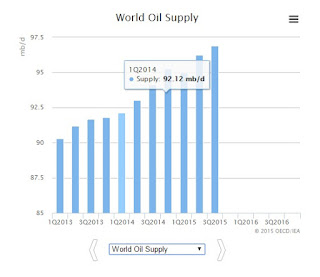

Two charts show this: the oil supply during the last fifty years (chart 2)

and the supply during the last 2.5 years ( chart 3).

|

| The development of the oil production from 1965 - 2010 Chart courtesy of consumerenergyreport.com Click to enlarge |

|

| The development of the oil production from 2013Q1 - 2015Q3 Chart courtesy of www.iae.org Click to enlarge |

As both these charts show, the oil production rose by approximately

12 million bpd during the last five years (2010 – 2015): an average of about

2.4 million bpd per year. High, but not extremely dramatic, when compared to

the period between 1965 and 1975.

What made these production changes of the last five years so

dramatic, on the other hand, was a. the fact that the oil production between

1975 and 2010 rose by an average of 0.7 million bpd and b. that these rises in

production took place during the worst economic crisis of the last eigthy years.

The following two charts show the development of the aggregate

demand for oil during the last few years and a composite comparison between

supply and demand, based upon these charts:

|

| The development of the oil demand from 2013Q1 - 2015Q3 Chart courtesy of www.iae.org Click to enlarge |

|

| The development of the oil demand and production from 2013Q1 - 2015Q3 Composite chart courtesy of www.iae.org Click to enlarge |

This composite chart makes perfectly clear that the divergence

between the oil supply and demand is as much caused by the increased production

capacity as by the “disappointing” development of the global demand for oil. In

my humble opinion, this makes 27 November 2014 a slightly less historical day

than Marcel de Boer argues in his column, as the increase in oil supply has not

been dramatically (!) higher since

2014Q4.

Suffice it to say, that the OPEC policy has not been

sensible in my point of view. The “war of attrition” that especially

Saudi-Arabia fought with the other (new) oil producing countries has blown up

in their faces, as the oil price is still extremely low and there are few

signals that it will start to rise very soon. Especially, as Iran is returning to the international limelight.

The fatal flaw that Saudi-Arabia and the other oil producing

countries made, perhaps, is believing in the fairytale of the everlasting

Chinese growth with the ‘magic’ 7% per year and that for a population of 1.3 billion people.

The growth of the oil production

has perhaps been based upon an expected demand, that was partially a figment of Chinese

governmental imagination.

The following table and charts are based upon Chinese statistical data

from the International Energy Agency, regarding the development of the Chinese oil consumption between 2000 and 2015.

Going by the (imho) realistical preassumption that a Chinese growth of 7% per year would lead to a growth in oil consumption

of roughly 7% per year or even (much) more, there has only been a 7%+ economic

growth in China between 2003 and 2007, as the following three charts show.

|

| The development of the Chinese oil demand from 2000 - 2015 Chart courtesy of www.iae.org Click to enlarge |

| Table comparing the growth of the Chinese oil consumption from 2000 - 2015 with their "magic" 7% growth rateand with a more realistical 6.2% growth rate Data courtesy of www.iae.org Click to enlarge |

|

| Chart comparing the growth of the Chinese oil consumption from 2000 - 2015 with their "magic" 7% growth rateand with a more realistical 6.2% growth rate Data courtesy of www.iae.org Click to enlarge |

The rest of the period between 2000 and 2015, the Chinese

growth has been meandering around 6.2% as the aforementioned table and charts show

beyond a reasonable doubt. Or even much less...

And to defend my preassumption about the correllation between economic growth and oil consumption: in a country with a developing middle class all coming from a rather poor standard of living, it seems

logical that the oil consumption would grow as hard or even much harder than the economic

growth, as more and more middle class people can afford to buy a car, a motor

cycle or other oil consuming means of transport and/or production.

The fact that

the oil consumption in China grew “only” by 6.2% per year in average, shows

that the economic growth has seldomly been north of the magic 7% in China, in

my humble opinion.

This is a point that has been defended over and over again,

by the savvy macro-economist of BNR Newsradio, Kees de Kort, based upon similar charts regarding imports and exports and production capacity.

The moral of this story is that the decision of the OPEC to

keep the oil tap fully open was not a wise one, as it led to an oil glut of

impressive proportions.

A fairytale that has been debunked over and over again, by people who just watch the independent statistics on China, like Kees de Kort does, and don't believe the ones provided by the Chinese government...

No comments:

Post a Comment